- Home

- Blog

- Sub Broker

- Role of Broker and Sub Broker in Capital Market

- Role of Broker and Sub Broker in Capital Market

Role of Broker and Sub Broker in Capital Market

- Published Date: January 04, 2021

- Updated Date: October 13, 2025

- By Team Choice

Incorporated enterprises are required to raise capital to run their businesses and manage their daily operations. These companies try to collect the capital from the financial market, to be precise, from the capital market.

The capital market has two divisions - primary and secondary market. The regulating authority of the capital market is the Securities and Exchange Board of India (SEBI), which took over the statutory power in 1992.

Now, the question is what does SEBI regulate? Well, it regulates all the financial instruments, including stocks, bonds, shares, and debentures which are also called “securities.”

Both primary and security markets deal with these securities. The primary market mainly deals with the first issues by companies during their inception period, and the secondary market takes care of securities listed by those companies on stock exchanges.

In this context it is important to illustrate the role of a broker and franchise of sub broker in the capital market.

Become a Sub Broker with Low Deposit.

- Highest Revenue Sharing

- Upto ₹ 1000 Per Account Incentive*

- Local Branch Support

- Lifetime Income Source

What Role Broker and Sub Broker play in the Capital Market?

The stock exchange is a crucial constituent of the capital market, where the buying and selling of industrial and financial securities take place. Brokers and sub-brokers play an important role in dealing with securities and help enterprises raise capital from the market.

Brokers and sub brokers also play the role of intermediaries based on their respective functionalities. Brokers are registered members of the stock exchange who work as agents on behalf of the investing public. So, they are the intermediaries between investors and the stock exchange.

Sub brokers work on behalf of brokers and are intermediaries between brokers and clients, and receive commissions for their services.

Sub broker is also known as an Authorised person. They play a crucial role in client acquisition, trade execution, and overall business expansion for the main stockbroker.

The Role of Brokers in Stock Market:

Suggest the Best Share Deals: Generally, brokers deal in various types of securities. Leading brokers suggest the best trading deals to clients by notifying them when to buy or sell stocks. Most brokers suggest trades based on research reports provided by sub brokers.

Margin Financing: In stock trading, margin trading is about the process where individual traders tend to buy more stocks than their affordability. Also referred to as “intraday trading,” margin trading makes it possible to complete all the stock transactions in a single day.

Nowadays, stockbrokers have strong capital reserves. Top stockbrokers lend capital to investors who want to consolidate their trading positions. Traders need to pay a margin amount, and subsequently, they can carry on with trading in the stock market. Usually, the margin amount is 50 percent.

Manages Stock Trading: Stockbrokers trade after receiving instructions from investors and implement them on a stock exchange. A full-service stockbroker or online brokers facilitate stock trading on various trading platforms where investors can trade by themselves.

Charges a Brokerage Fee against Services: Full-service stockbrokers charge a brokerage fee for their services to investors. This charge is a percentage of the trading revenue they generate for clients. According to law, brokers can charge a maximum of 2.5 percent brokerage fee to their clients. Discount brokers charge a flat commission which is pre-determined on every executed trade.

The Role of a Sub Broker in the Share Market:

Sub brokers work for stockbrokers to acquire clients by offering services relating to buying and selling shares, bonds, and other securities. Getting insights into the sub broker business model will help you understand the profession.

Sub brokers are not registered with the stock exchange. They work on behalf of stock broking houses and develop a business network for them.

Sub brokers must get registered under SEBI. On top of it, sub brokers get into a contract with the stockbroker the outlines the rules, rights, regulations, and economic terms of both parties.

Talking about sub broker eligibility, one has to fulfill certain qualifications in order to take on sub brokership as their career.

Sub Brokership Eligibility:

- Should be at least 10+2 or HSC qualified.

- Minimum 21 years or above.

- Not a trading member of a stock exchange.

- Not a registered sub broker with any other stockbroker.

- Not a partner or shareholder of a registered sub broker.

- Has not been a defaulter in any stock exchange.

After becoming a sub broker, an individual needs to learn about his/her role and functions in detail. Here are they:

For the Stock Exchange

Sub brokers are not direct members of a stock exchange and, therefore do not list directly there. However, sub brokers perform certain functions in that regard.

A sub broker receives a franchise from a stockbroker. Once franchised, the main role of a sub broker is to offer clients useful advice on how to deal with stocks and help them make better investment decisions.

Therefore, when it comes to stock exchanges, the main function of a sub broker is to maximize the number of trades.

For Stockbroker

Sub brokers work on behalf of reputable stockbrokers and carry out several duties for the broking house. Lets know the roles of a sub broker towards a stockbroker.

Functions of Sub Brokers towards a Stockbroker

Developing a Large Client Base: Under the banner of a stockbroker, the main role of a sub broker in stock market is to help maximise trading in that area. The person responsible for expanding the size of the business by attracting a large number of clients interested in investing in stocks and securities.

Obtaining Quality Deals: Sub brokers are gatekeepers whose primary role is to prevent investors from submitting incorrect documents to stockbrokers and maintaining the integrity of the capital markets.

Keeping the Deals Transparent: Sub brokers work closely with stockbrokers to maintain and index all documents related to each transaction that passes through them. They work in the best interests of their clients concerning dividends, bonus rights, stocks, and other assets. They should also help stockbrokers replace documents marked invalid.

Help the Stockbroker in Sales: They are required to inform the stockbroker of all transactions performed by their investors and issue coupons on behalf of the broker.

For Investors

Sub brokers play an important role in helping investors maximise their return on investment. A sub broker’s ability to bring in clients, along with identifying and dealing in profitable trades is invaluable. In this way, sub brokers help brokerage firms to expand their business and generate significant returns for investors.

A sub broker also helps clients by providing useful tips and market updates on the best deals so that they make informed decisions. A sub broker needs to understand their clients’ requirements and financial goals and guide them towards the most lucrative investment opportunities.

Conclusion

Sub-broking is a profitable business, especially for people who are good at networking and interested in generating a steady income from the stock market.

These days, many leading stock broking houses in India offer their sub-broking and partnership programs to help people transition to become sub brokers.

If you are interested in venturing into sub broking without deposit, you can think of partnering with a reputable full-service broking firm like Choice.

Recommended for you

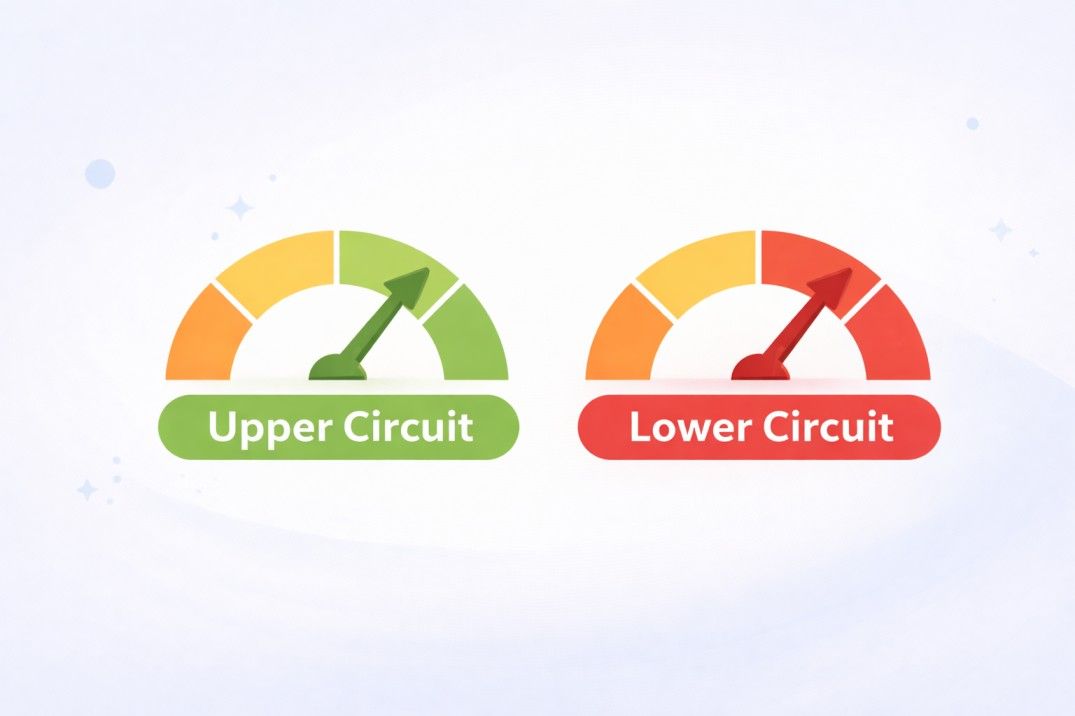

What Are The Upper Circuit and Lower Circuit?

What Is The Difference Between Large Cap, Mid Cap, and Small Cap?

FII DII Data - Live Data