IPO Listing

- Published Date: December 21, 2021

- Updated Date: November 18, 2025

- By Team Choice

The company is getting listed on the stock exchange, you might have come across this statement several times. But what actually is an IPO listing.

In this article, we will cover a complete detail of the listing of the company via IPO and other features.

But before that, let us shed some light on the what is IPO. initial public offering or IPO is an initial step for a company to go public or get listed on the stock exchange. It is through an IPO for the first time that a company brings out the shares to the public eye.

A company follows a certain procedure before getting listed in any of the exchanges in the Indian Stock Market about which we’ll learn further in the article.

IPO Listing Stock Exchange

Now it is pretty obvious that if any organization is trying to move into the share market space, it must list itself with the stock exchanges such as the NSE or BSE.

In most cases, companies are listed in both NSE and BSE for which they are required to pay certain fees during the process of submitting the DRHP to the SEBI.

As per BSE and NSE, the main objectives of new listings are :

- To provide liquidity to securities

- Deploy the savings or funds for economic development

- Provide full disclosure to the investors

Open a FREE Demat Account in 5 Mins.

- Free AMC for First Year

- Low DP Charges (₹ 10)

- No Auto Square Off Charges

- Free Research Calls

IPO Listing BSE

As we’re talking about IPO listing in BSE, it becomes important to know the terms and conditions the organization needs to follow.

It is interesting to know that BSE has a separate listing department to grant approval on new listings as per SEBI guidelines.

- For any company to be listed with BSE, must have a minimum post-issue paid-up capital of about ₹10 crores.

- Also, the minimum issue size should be ₹10 crores

- And the market capitalization of the applicant company must be around ₹25 crores.

Only then will the company be able to register itself with BSE. Not just that the initial listing price in BSE is ₹20000 annually. In addition to this, certain listing charges are also levied based on the listed capital of the company.

NSE IPO Listing

Now here the minimum requirement to list the IPO with NSE remains the same as that of BSE. The applicant company must have a minimum of ₹10 crores post issue paid-up capital.

- While the equity capitalization of the applicant must not be less than ₹25 crores. Also, the organization seeking listing will only be granted approval on fulfillment of all the requirements as per the SEBI guidelines.

- For which the company will be asked to submit its annual reports of the past three years at least. Which will be verified by the NSE with regards to part insolvency cases or any sort of bankruptcy.

- The company must not have received any wind-up notices in the past.

When all these parameters are thoroughly verified by the NSE listing department, it grants permission to the company for further proceedings.

Now that we’ve seen the eligibility criteria let’s move on to the IPO listing process.

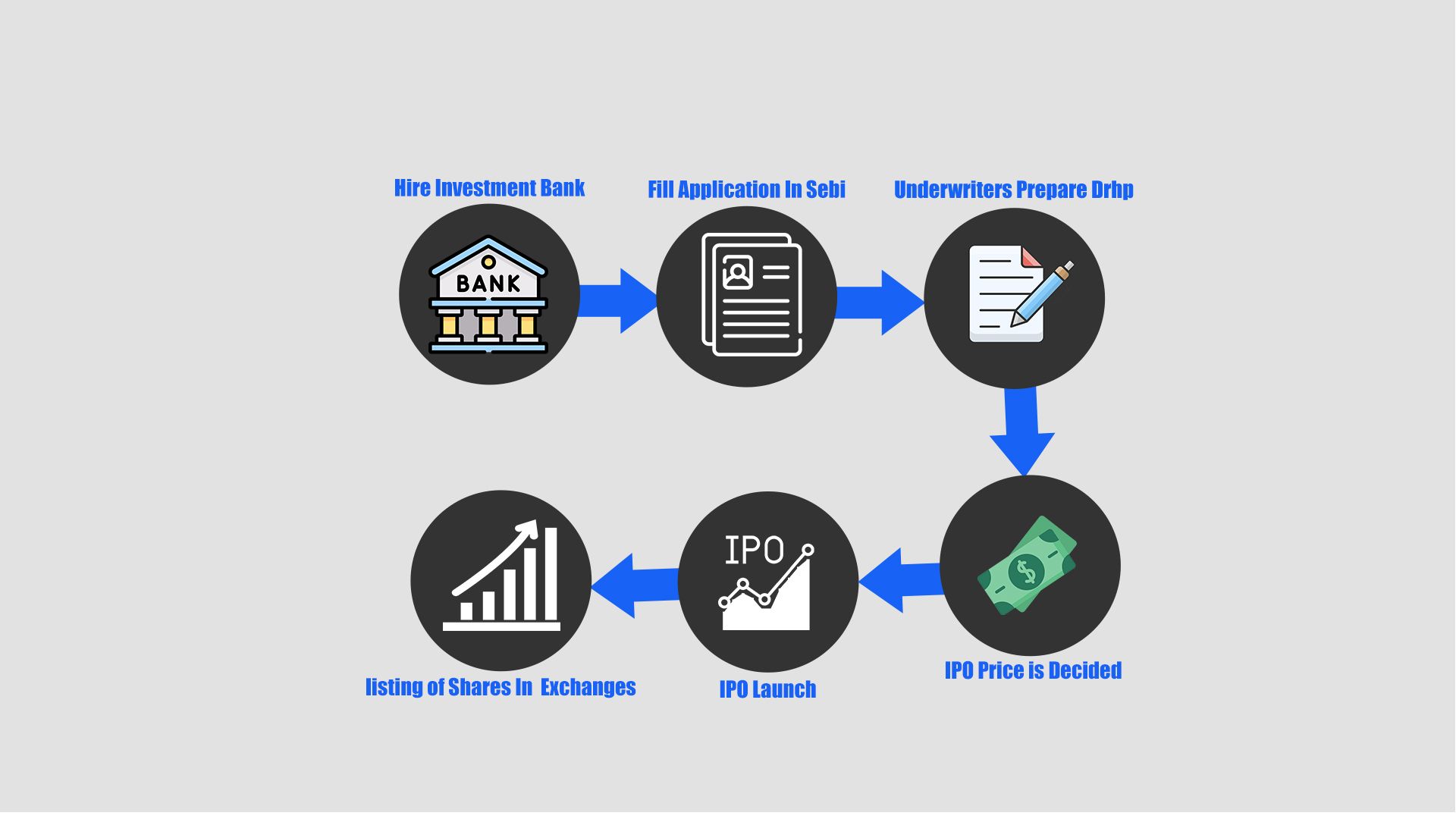

IPO Listing Process

The process remains simple yet complicated and tiring. For it takes a lot of money and time from the applicant company.

- First, the company hires the right investment bank for the issuance

- Then it fills the application in SEBI

- On receiving the hint, the company then hires the underwriters for preparing the red herring document called the DRHP

- Upon approval, IPO price is decided

- Finally comes the Launch of IPO

- And hence, listing of shares in exchanges.

So you see, this 6 step process followed by the company takes from several months to even years just to get its IPO listed.

IPO Listing Details

Once all the formalities are completed the investors are free to invest in the IPO. Now comes the IPO listing details, these are nothing but the listing price, the listing date, along with that it is also important to know the pre-open time. Let us dive a bit more into it.

How to Know the IPO Listing Date?

First, it is important to know what the IPO listing date means. The listing date is the day when IPO shares start trading in stock exchanges.

When the company publicly files its DRHP, which includes the company’s details, after SEBI finally grants the approval, the company opens the IPO application portal, that’s when the IPO listing date is announced.

Although, the share market timings are from 9:15 AM- 3:30 PM. But the case is not the same with IPO listing. Let us have a look at the details of the same.

IPO Listing Time

The IPO gets listed in the market at 10 AM on a listing day. It is only after this time that an individual can start trading in the stocks of that particular company.

Although, there is a pre-session as well in the IPO listing. The timings for the same are from 9 AM- 9:45 AM. The order during this time can either be placed, modified, or even canceled.

From 9:45 AM- 9:55 AM, the trading in the IPOs is closed. After 9:55 AM, till 10 AM, there is a buffer period. Post 10 AM, you can easily trade in the stocks of the company.

IPO Listing Price

Now there is an offer price that the company decides for the IPO by analyzing and deciding the valuation of the company. This is very different from the Listing price of the IPO.

The listing price of an IPO is the price at which the shares of a certain company get listed in the stock exchanges. This price can vary depending on a lot of factors but majorly because of the increasing demand and supply of a particular share.

It is the debut price at which the trades start trading the IPO shares in the secondary market.

Now, let us have a look at the factors that are responsible for deciding the listing price of a company.

How IPO Listing Price is Decided?

Many people get confused on what basis the IPO listing price is decided. The answer is simple, the entire concept is based on the demand and supply of the company shares.

So basically the overall demand of the company’s shares decides the listing price.

The demand is known by analyzing the subscription percentage.

The IPO which is generally oversubscribed gets listed at a higher price than the one that is undersubscribed.

Other than this the trading of IPO in the Grey Market, i.e. the IPO Grey Market Premium. Have you ever wondered why GMP is important in IPO.

Well, the premium amount in the Grey market plays a vital role in determining the listing price and helps the investor to evaluate the listing gains they can make by applying in the IPO.

The overall demand, the bid price and the GMP value evaluate the listing price of the IPO.

Few other factors determining the listing price of the IPO are:

- Current market condition

- Investors’ sentiments

- Global Factors

- Current Political condition

Depending on the IPO listing price, an investor can either benefit from the trade or suffer losses. Let us closely look at the details for the same.

IPO Listing Gains

A lot of individuals enter the IPO market to take benefit of the listing gains. But what are the IPO listing gains?

When a company makes its shares public in the stock market, it comes with an offer price. The difference between this offer price and the listing price is known as the listing gains if the result is positive.

For example- If the offer price of an IPO is ₹100 but it has listed at ₹150 per share, then the listing gain, in this case, is ₹50.

So, if you want to make the most out of this situation, you can sell IPO shares on listing day and earn great profits.

But the question is, how to sell IPO shares on listing day?

How to Sell IPO Shares on Listing Day?

If you are looking for potential gains and want to sell your shares, you can easily do that from the trading app of your selected stockbroker. You have to wait till at least 10 AM to start trading in the stocks.

Open the app using your name and password. After that click on the holdings tab. Here you will see the IPO shares that are allotted to you.

You can simply sell them by clicking on it and then on the sell button. Enter the price, quantity, order type and click on the sell option.

If there is enough liquidity in the market, your order will get executed after successful verification. In this way, you can easily make profits on the listing day itself.

But do you always make profits on a listing day? Obviously not! Some investments can also reap some negative effects on your portfolio. These are the IPO listing loss.

IPO listing loss is nothing but the loss inventors have to face when unexpectedly listing price drops as soon as it moves into the secondary market due to whichever reason.

Advantages of an IPO

- IPO offers an opportunity to buy at a comparatively lower price and then sell it at good profits.

- IPO is yet another way to generate profits other than regular trading in the stock market.

Disadvantages of an IPO

- IPO is an exhausting and time taking process.

- Since the organization decides to go public, for every decision taken, it is answerable to its investors be it the promoter or even the real investors.

Conclusion

To sum it up, we’ve learned about IPO listing in this article, about how it works, and what details need to be focused upon by the applicant organization.

And also how the post listing situation affects the investors in the form of listing losses or listing gains.

No wonder, many investors invest to reap the listing gains but before that, it becomes crucial to understand the pros and cons of investing in the IPO.

If you are looking to invest in the IPO, open your demat account today!

Recommended for you

Copper Price Forecast for Next Week

What Are The Upper Circuit and Lower Circuit?

What Is The Difference Between Large Cap, Mid Cap, and Small Cap?