IPO

- Published Date: December 29, 2021

- Updated Date: June 17, 2025

- By Team Choice

IPO has become the buzz of the town. Numerous companies are now running in the marathon of bringing out their IPO to get visibility in the stock exchanges. But the question is, what is an IPO? How does it matter to a company or an investor?

This article will cover all the essential aspects of IPO and how it works. But before diving into the details, let us first understand the meaning of an IPO.

IPO Meaning

It wouldn’t be wrong to say that the nation is drowning in the pool of IPOs. While some of them have made it really big this year, some of them were not able to meet the expectations. But the question is, what is an IPO?

IPO is simply a process through which a private company goes public by selling a part of its shares to new investors. After the company’s IPO is launched, various retail investors bid for the shares and only after this does the company get listed.

It is commonly known as the primary market, as it gives the investors a chance to become a part of the company by letting them apply for the IPO before the company moves to the secondary market.

Once it gets listed in the stock exchanges, any investor with a demat account can trade in the shares.

Open a FREE Demat Account in 5 Mins.

- Free AMC for First Year

- Low DP Charges (₹ 10)

- No Auto Square Off Charges

- Free Research Advisory

Let us understand this with the help of an example. Imagine you opened a small online apparel store some years ago. The growth was steady, but it touched its peak during the lockdown. After seeing the success, you decided to expand your business. However, you don’t want to spend a chunk of your savings on this and don’t want to take a loan from the bank as well.

So, what are your options now?

Weighing all the possible outcomes, you decide to sell some shares of your company to the investors. This will raise the capital and give you an opportunity to monetise your business even better.

This is precisely the process of an IPO. But why will a private company go public?

There are various reasons why a company brings out its IPO. Let us discuss some of them.

- The primary objective of a company for bringing out an IPO is to raise capital. Now, this can be for various reasons like an expansion of the business or fulfilling the operational costs.

- Another reason for a company for bringing out its IPO is to clear the debts.

- It is also an opportunity for the company’s existing shareholders to liquidate their shares in the secondary market.

- IPO gives a chance to the company to get listed in the stock exchanges. This increases their visibility and also their credibility.

So, IPO is a pathway for private companies to enter the secondary market and reserve their seats in stock exchanges.

IPO Full Form

The full form of IPO is Initial Public Offering. These days, many investors are interested in IPOs because of the great returns and profits they generate. Therefore, the full form of IPO has a lot of significance and delivers the concept’s meaning as well.

Since the significance of Initial public offerings has increased for the company and as well as the investors in recent years, it has also become essential to understand the reason behind it.

The companies and investors have different expectations when aiming to get their company listed, but the bottom line for both parties remains the same: generating income.

IPO full form also accompanies the meaning of IPO because it is for the first time that the company is getting visibility for the public.

Every company files a DRHP (Draft Red Herring Prospectus) before it brings its IPO. In this document, the company states all the financial details, the details related to the Initial public offering, its objectives, and so on.

An investor can very well figure out whether to invest in an IPO or not after reading this document.

Now that we know the full form of an IPO and its meaning, let us talk about the types of an IPO.

Types of IPO

The IPO’s meaning is clear, bringing us to our next point: the type of IPOs. There are two major types of Initial public offering in the Indian market. The significant difference between the two is the issue price and the way that is offered to the investors.

The two types of IPO are,

- Fixed Price Issue

- Book Build Issue

Fixed Price Issue

In this IPO, the company decided on a fixed issue price and the same is made available for the investors. The underwriter chooses the price by keeping certain things in mind. For example, if the issue price is set at ₹100/share, then the investors have to pay the entire amount when applying for that particular Initial public offering.

This means that the company publics only one price, and therefore, the investors get to know the price of the issue.

Book Built Issue

Unlike the fixed price issue, there is no set issue price given by the company in this type of IPO. Instead, the company sets a price band of 20%. When the Initial public offering opens, the investors can pick their price between this range. Along with this, they also have to select the number of shares.

The final price of the IPO is decided to depend on the bids of the investors. This is one of the most popular types of Initial public offering in India, and various companies work along this line.

So, these are the two types of IPOs that are issued to investors in India. But we talked about the issue price here, let us now look at the meaning of the same.

IPO Price

The IPO price is one of the most critical aspects of the IPO. It all circles around the price after all. Just like there are different types of Initial public offering, there are some prices as well that are important for an investor.

Right from the day when an IPO opens to the day when the company finally gets listed in the stock exchange, it is a journey. And along this journey, a lot of prices are decided and looked at. The details of the different IPO prices are given below.

- Issue Price- This is one of the first prices that accompany the journey of an Initial public offering. This is the price at which the shares of the company are made available for the investors for the first time. As discussed earlier, the issue price is already set by the company in the fixed price issue. Whereas in a bookbuild issue, the issue price is kept at a 20% price band.

Now, these issue price is also further divided into two different parts.

- Fresh Issue Price- This is the price of the shares that are getting available for the investors for the first time. The already existing shareholders don’t have any part of these, and it is for the first time that the company is planning to raise capital via these shares.

- Offer for Sale- We know that the Initial public offering of a company also gives a chance to the existing shareholders to liquidate their shares. So, the price of the shares that the current shareholders are exiting with the Initial public offering is known as an offer for sale.

- Price Band- Another important term related to Initial public offering price is the price band. Now, this is applicable only for the bookbuild issue. The price band in an Initial public offering is the range between which the investors can place their bet. The upper price is usually known as the cap price, and the lower price is known as the floor price.

These are the important prices that you need to keep in mind when you are thinking of investing in an Initial public offering.

Now after understanding the various terms, the question arises, how to apply for an Initial public offering?

IPO Application

IPO application refers to the process wherein the investors can apply for an Initial public offering through the demat account of your registered stockbroker. IPO application is a great way for not just beginners but for every investor to earn money from the share market.

The Initial public offering remains open for 2 days within which you can apply for an IPO online or you can also opt for the offline method.

Although the share market timings are from 9:15 AM- 3:30 PM, the IPO Apply time is different. If you want to apply for an IPO, you can do that between 10 AM-5 PM. It is also necessary to note that these timings can differ from broker to broker. Some brokers can keep it till 4 PM as well.

Let us now have a look at the process of IPO application and how you can easily carry that out.

How to Apply for IPO

Gone are the days when you had to hustle for everything. Now you can complete everything sitting in the comfort of your own place. Similar is the case with IPO as well. You can apply for an Initial public offering through both online and offline methods.

FinX by Choice gives you an opportunity to apply for any Initial public offering very easily and directly from the app. You have to apply for an IPO through ASBA now in both the offline and online methods.

In the ASBA process, the amount is blocked in your bank account till the time the IPO shares are not allotted to you. If the shares are allotted to you, the amount is debited from your account and if not, the amount is unblocked and hence reflected in your bank account.

Let us now have a look at how you can complete the application process conveniently.

- Open the trading platform of your stockbroker and then click on the ‘IPO Option’. In the Choice FinX app, this segment is quite prominent and you can easily find it in the side menu.

- Now you will see a list of open Initial public offerings along with the details.

- Select the Initial public offering that you want to apply for.

- Enter the lot size, price, and payment method. Choice gives you an opportunity to place your order through UPI easily.

- Verify all the details and click on apply.

- You will receive a mandate to block the desired amount in your bank account. (minimum investment for IPO is ₹15,000, whereas the maximum investment is ₹2,00,000)

- On approval, the required amount will be blocked in your demat account.

There is also an offline method through which you can apply for an Initial public offering. All you have to do is go to the NSE website and download the ASBA e-form. Then, fill in the form with the desired information and a cheque of the amount. Once you submit the form, the amount is blocked in your account till the time the IPO allotment process is not complete.

It is important to note that the amount is not deducted from your account and is just blocked. So now that we have talked about the IPO application let us discuss the IPO allotment process.

IPO Allotment

After the application process, the most crucial part is the allotment. The process in which the shares are given or allotted to the investors is known as the IPO allotment.

Now some people get the IPO allotment, and some don’t, so the question here is how does IPO allotment work?

When an IPO opens, the subscription can differ because of the demand of that particular Initial public offering. The allotment process differs in all cases.

- When an IPO is oversubscribed, that is, when an IPO receives more bids than the shares. In this case, the shares are allotted to the investors on a pro-rata basis. If the Initial public offering is lightly oversubscribed, then the company tries to give at least 1 lot to every investor. The rest of the shares are distributed among the investors proportionally.

But in the cases where an IPO is overly subscribed, like in the case of a lot of IPOs these days, the allotment happens through a lucky draw.

- When an Initial public offering is properly subscribed or undersubscribed, then there is no difficulty in the allotment of shares. In this case, all the investors get the IPO allotment.

Let us now move to the next step, which is the listing of the Initial public offering.

IPO Listing

When the shares finally get listed on the stock exchanges, it is known as IPO listing. After the listing process, the company receives visibility in the secondary market. You can further trade these shares depending on the market conditions.

A lot of investors apply for the IPO so that they can sell their shares at high prices on a listing day. These are known as the listing gains. Where this is a good way to earn money through IPO investments, you can always invest for the long term as well.

IPO listing is the last step in an IPO process because post this, the company moves from the primary market to the secondary market.

Noe, as we talked that the listing price can vary depending on the demand of the Initial public offering. There are various other factors that influence the listing price. One of those factors is the GMP. In the next section, let us talk about the IPO GMP.

IPO GMP

Grey Market Premium is an important factor in determining the IPO listing price. But what is IPO GMP? So, before the IPO gets listed in the stock exchanges, the shares are also traded in a parallel grey market.

This is an unregulated market and often denotes the demand for a particular Initial public offering. The extra amount that an investor is willing to pay for a particular share of an Initial public offering in the grey market is known as the grey market premium or GMP.

For example, if the issue price of a particular IPO is ₹100/share and it is currently trading at ₹150 in the grey market, this means that the GMP of that particular IPO is ₹50.

But why is GMP important?

It is often believed that the higher the GMP, the higher is the demand of the Initial public offering, And this further denotes a direct significance in the listing price as well. It the GMP of an Initial public offering is showing positive growth, it is expected that the IPO will list at a good listing price, thus generating good returns.

But, it is not always the case. So, it is very important that if you want to invest in an Initial public offering, you should not just depend on the GMP but also read and analyse the company before investing your money.

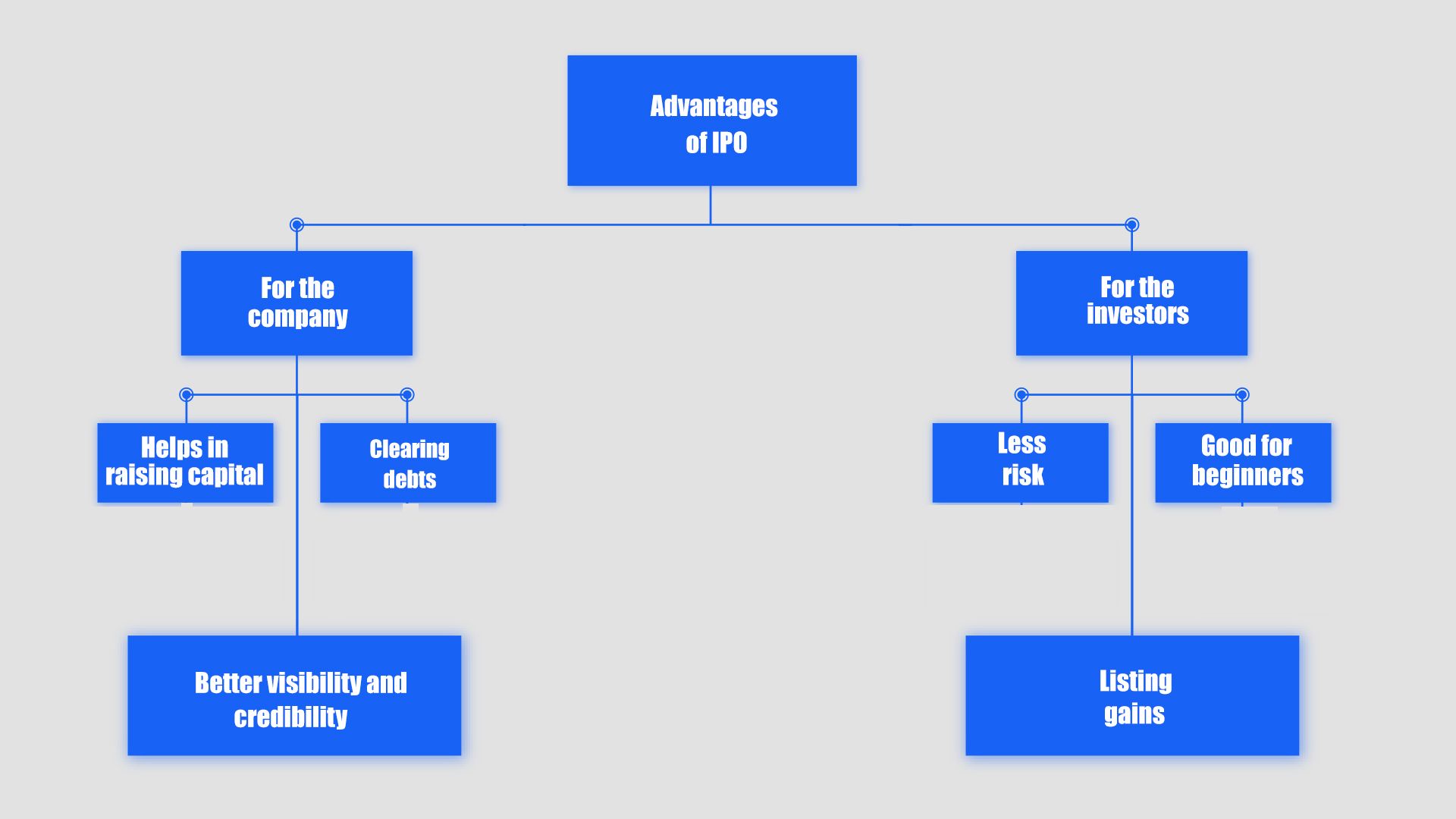

Advantages of IPO

So, the initial public offering can have various advantages for the company and as well as the investors. Let us discuss some of them in brief.

For the Company

- Whenever a company moves from a private space to the secondary market, it helps them in generating wealth.

- IPOs also helps them in fulfilling the operational costs or paying out the debts.

- It also gives the company an opportunity to gain better visibility and credibility in the market.

For the Investors

- It is a good opportunity for beginner traders to enter the stock market space as the risks are minimized.

- The listing gains in an Initial public offering can generate a good profit as soon as the company gets listed in the stock market.

Disadvantages of IPO

Just like every coin has two sides, an Initial public offering also has some disadvantages. The company is supposed to release all the financial data and objectives when it wants to get listed, this can serve as a drawback for the company.

On top of this, if an investor is not aware of the IPO or its technicalities of it, the investor might face losses as well.

Therefore, it is important to properly analyse and then invest in an Initial public offering.

Conclusion

IPO gives an opportunity to the investors as well as the private companies to get a better opportunity at generating returns. A company gains better visibility and it also serves as a milestone in the growth of a company. You can easily apply for an Initial public offering through your trading apps and wait for the profits. But always remember to first analyse and then invest your money.

If you are thinking of investing in an IPO, you need to open a demat account!

Recommended for you

Indian Stock Market Prediction For Next Week

FII DII Data - Live Data

Choice International Ltd Steady Start to FY26: Q1 Sets The Tone for Sustained Growth