Types Of Stock Market Investment

- Published Date: December 21, 2021

- Updated Date: November 28, 2025

- By Team Choice

Stock market investment is an abstract term, and to get into the foray of investments without the faintest idea of the types of stock market investment is like driving a vehicle without its wheels.

It is necessary to understand the various types of stock market investment with each of their benefits, limitations, and risk-reward metrics if you want to earn money in the stock market.

So for you to know which type of stock market investment is suitable for your abilities and ambitions, we have tried to explain in concisely form all of these options, which, upon reading, will help you in making a choice.

Also, you can pick the one that can offer you high returns with the minimum stock market risks.

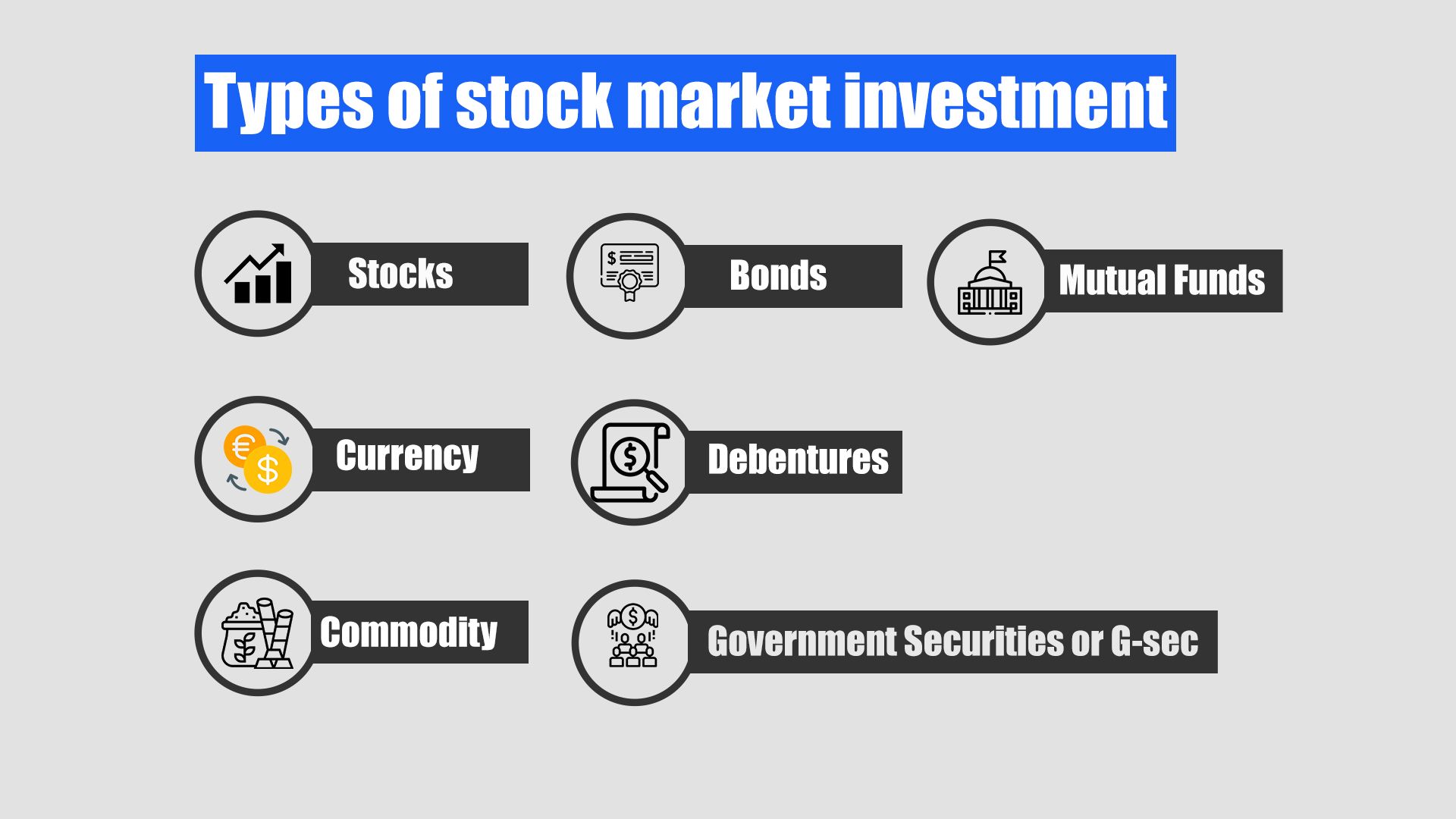

Types Of Investment in the Indian Stock Market

Whether we talk of the Indian stock market or the global market, the types will more or less remain constant. Investors usually practice a mixed technique of investments in the stock market; that is, they will choose different options of investments instead of going with just one.

But before going into complex strategies of investment, let’s define each of these types of stock market investments:

Shares or Equities

One of the easiest and most popular types of stock market investment is the stock or equities investment. Incidentally, in this investment, whenever one buys a company’s stock, they will automatically become stakeholders in its ownership.

The simple concept of investing in stocks and equities is that one buys or sells shares of one or multiple companies to make high returns in the market. And what’s even more encouraging about this type of investment is that most profit-making remains neutral on the inflation rate.

However, there is always a high risk involved in equities trading. This is primarily because the volatility and overall market behaviour are difficult to comprehend even for seasoned investors, but that is not to say that practice can’t make you “relatively” perfect.

Commodity

Commodities investment is defined as investing in goods or assets of various sectors such as agriculture, metals, energy, etc. Precious goods like gold and silver are also traded under this segment of investment.

But this trading is different from simply buying and selling shares. In fact, in commodities investment, trading is commenced through derivatives, ie, Futures, and Options.

These derivatives are simple contracts that act as an agreement between a buyer and a seller wherein all the essential parameters such as quantity and timeline of order executions.

Now the commodities in India are divided into two major segments namely: the Agri commodities and the non-Agri commodities. A trader can easily trade in the time defined for various commodities.

It functions in reference to the global markets as well, therefore the share market timings in the case of commodities are different. If you want to trade in the commodity segment, you can do that between 9:00 AM- 11:55 PM (non- agri commodities) and 9:00 AM- 9:00 PM (agricultural commodities)

Currency

The Currency market is nothing but the foreign exchange market. It’s also known as Forex. In the Indian stock market, currency trading can be done in four currencies like Dollar, Pound, Euro, and Yen.

In simple terms, the profit or losses will depend on the exchange rates at a given instant of time. So, global fluctuations in the exchange rate are taken advantage of by investors by the method of scalping. Hence, this scalping depends upon the volatility of the exchange market.

Mutual Funds

Mutual Fund is a stockpile of several investors’ or traders’ assets. Mutual Funds requires proper management by using the services of Fund Manager, that will choose the investments for you.

The compilation of assets in Mutual Funds can be varied. So, it can be a combination of shares, bonds, commodities, currencies, and derivatives.

The level of risks involved in Mutual Funds is identical to the one in Equities but since Mutual Funds is a collective of assets hence the chances of profit-loss balancing is higher.

Bonds and Debentures

Bonds can be explained as a document or receipt of an amount that you lend to a body. Now this body can be the Government or a Corporate firm. But a simple question here is, how does one make this bond trading any profitable?

Well, the thing about lending is that one can make money by receiving interest on the lent amount. So the lent amount will become the principal amount that you will get back once the bond matures on a set time or date.

Debentures as an investment option are quite similar to Bonds, but the risk factor of Debentures is slightly higher in comparison to Bonds. And Debentures are issued with certain key objectives in mind, such as business expansion etc.

Government Securities or G-Sec

Government Securities function on similar lines as the bonds do. But the bonds that are only and only issued by Central or State governments are referred to as Government Securities or G-Sec.

The government issues G-Sec with the purpose of raising funds for development-related projects. The best thing about such types of stock market investment is that they are safe to invest in as the risk factor gets diminished considering there’s the mark of Government.

Further, G-Sec can be divided between two major categories namely long-term and short term bonds which solely differ on the basis of the time period in which these G-Secs turn mature. This range can be anywhere between 5-50 years.

How To Start Stock Market Investment?

First step to get into the space of stock market investment is to open a share market account.

You can open it easily with any of the stockbrokers that can offer you better services at a minimal price.

After opening a demat account you can plan your goals and then pick the stocks. Here just knowing that there is a long-range of options to choose from when you start investing, does not mean that you select any of the types of stock market investments as your first step.

The point to ponder here is that an investor must determine their own level of knowledge and skills in stock market investment before jumping onto any of these types.

Stereotypes are for a reason. It is not whimsical of seasoned traders to have started with the Equities market before even considering other options. In fact, even within equities, most beginners stay away from Commodity and Currency trading because of a lack of confidence and practice in investments.

Keeping in mind the risk-reward factor one must choose wisely, not necessarily meaning that you need to follow the crowd, the only point being that you ought to be prudent and must be able to gauge your own risk appetite.

Conclusion

Being aware of the intricacies of the stock market is a plus point. And one such intricate detail is the availability of various types of stock market investment.

However, one must duly consider each of these types independently before deciding on an investment.

To invest requirements requirements requirements in any of these types, you will need to open a Demat Account. Open one with Choice today.

FAQ

Types of Stock Market in India

There are 2 major types of stock market

1. Bombay Stock Exchange (BSE)

2. National Stock Exchange (NSE)

Recommended for you

FII DII Data - Live Data

Copper Price Forecast for Next Week

Types Of Foreign Direct Investment (FDI): Benefits, and Key Factors