IPO Meaning

- Published Date: December 21, 2021

- Updated Date: June 17, 2025

- By Team Choice

A lot of investors are now showing keen interest in the IPO market. The reason being the numerous advantages that it brings along.

But do you know how IPO works?

IPO is a way for a private company to set its steps in the public space offering the retail traders an opportunity to be a part of the company. There are various factors and rules related to an IPO.

Let us now explore the IPO meaning in detail!

IPO Meaning in Share Market

Before we begin with what is an IPO, let us have a look at the IPO full form. IPO stands for Initial Public Offering and itself reflects a lot in it.

Let us understand the IPO's definition with the help of an example. Suppose you run a restaurant in Delhi for over 5 years now. Looking at the profits that you have generated and the brand image that you have created, you want to set up another branch in Chandigarh. So you decide on everything but the only problem is that you are running short on capital.

You don’t want to take a loan from the bank so what are possible solutions for you? You can sell a part of your stake to any investor in order to generate some capital for expanding the business.

Now, this process is known as an IPO or Initial Public Offering. This is a process by which a private company goes public by putting up a part of its stake for other investors.

Open a FREE Demat Account in 5 Mins.

- Free AMC for First Year

- Low DP Charges (₹ 10)

- No Auto Square Off Charges

- Free Research Advisory

The reasons behind a company bringing out an IPO can range from, generating capital to expand the business, to start the trading of the current shares, having better visibility in the market and a chance for the old investors to exit from the company.

If we see it from the eyes of an investor, then it gives part ownership to the investor, also a chance to take the advantage of the listing gains, and get a place in the company before it reaches the secondary market.

Now, you must be wondering what is the secondary market? So, when the company gets listed in the stock market, the shares are said to be traded in the secondary market.

The IPO is said to be in the primary market, where the shares are traded before it becomes available for the public eye.

Before a company decides to launch its IPO, it files a DRHP (Draft Red Herring Prospectus) which contains all the details to SEBI. Only after SEBI approves the offered draft, a company can announce it to the investors.

Types of IPO

Now, you do understand the IPO meaning contextually. However, there is a lot more to it. There are multiple types of IPOs in the share market for you to invest in them.

After all, the companies that are looking to raise funds must be given different options to do it. At the same time, it makes total sense for you to learn these types so that you can plan and apply them accordingly.

Here are the details:

Book Build Issue

Now you must have seen this term attached to a lot of IPOs, but what does it mean? So in the bookbuild issue, the price of the shares or the issue is totally dependent on the demand of the same. If there is more demand, the price will automatically rise with respect to that, and vice versa.

These prices are decided by the investors and their interest in a particular issue. Before the price is decided the investors bid on the issue and then the price is fixed.

Fixed Price Issue

As the name of the issue suggest that the price in it is fixed beforehand. The investors are made aware of the price before the shares start trading in the secondary market. For example, if the share price is fixed at ₹100, it will be traded for the same, irrespective of the demand.

Now, there are various different terms associated with an IPO that an investor should be aware of if they are certain about applying for an IPO.

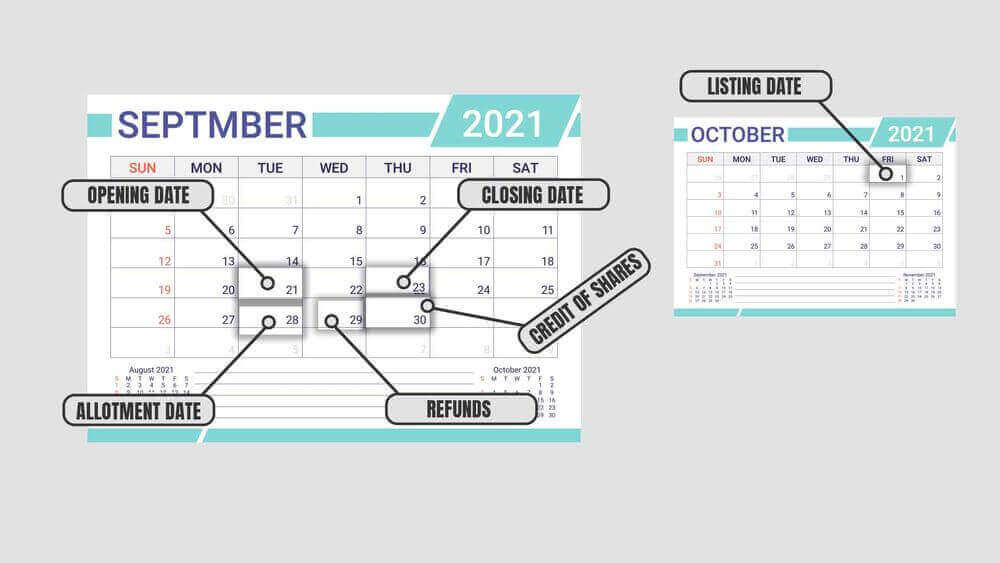

IPO Date Meaning

When a company is about to launch an IPO, several dates are fixed keeping the things in mind. The dates are specifically mentioned in the DRHP so that the investors are informed beforehand.

The several dates that an investor has to keep an eye on are as follows.

- Opening Date– This is when the IPO opens for the different types of investors and they can start bidding accordingly.

- Closing date– This is the date till which the investors can bid for a particular IPO.

- Allotment Date– This is the date when the shares are allotted to the investors.

- Refund Date– Not all investors get the allotment of an IPO. The ones who don’t get the allotment, get their money back by a certain refund date.

- Shares credit date– This is the date when the allotted shares are credited to the Demat account.

- Listing date-This is an important date as this is the date when the company gets listed in the secondary market.

IPO Price Meaning

Now another thing that is very important when it comes to an IPO, is the IPO price. Let us have a look at the different prices that an investor should watch before anything else in an IPO.

- Issue Price- This is the most important of all. This is the price that the company is planning to offer for the shares when it goes out to the public for the first time.

- Fresh Issue Price- This is the price of the shares that are coming out for the investors for the first time.

- Offer For Sale- These are the shares that are owned by the existing shareholders and they are using the IPO as an opportunity to sell their shares.

- Price Band- This is the range that is provided by the company and the investors place their bids in this range.

IPO Grey Market Premium Meaning

Another important thing that is associated with IPO is the premium or the Grey Market Premium. It is the price at which the shares of an IPO are trading in the grey market before getting listed in the secondary market.

Generally speaking, this is the price that an investor is willing to pay on top of the decided price of an IPO share. For example, the price of an IPO share is ₹200. And its GMP is ₹150. This means that an investor is willing to pay ₹350 instead of ₹200 for a particular IPO.

But why GMP is important in IPO?

Here, the answer is clear, the higher the GMP means, the higher the demand, and thus higher the listing price. Usually, a good GMP gives an idea that the investors will get the touch of the listing gains.

Learn how to calculate GMP of IPO to avoid any confusion and to apply for IPO in the Grey Market.

Further, wondering how to sell IPO in Grey Market? Well, the process is completely done in the private market without the involvement of exchange or stockbrokers.

The two parties (buyer and seller) get in touch with the private dealer who then helps them in the process of buying and selling the IPO shares or application in the Grey Market.

Since the whole process is done in an unauthorized way, it is therefore important for an investor to monitor the IPO premium very closely.

IPO Subscription Meaning

Have you ever heard that an IPO is oversubscribed? But what does this mean?

So when a company is launching an IPO, it is looking to raise capital against some shares. The investors are then asked to bid for the same.

If the number of bids is more than the number of shares, the IPO is called oversubscribed. For example, if there are 200 shares and the bids received are 2000 or more, the IPO is 10 times oversubscribed.

An oversubscribed IPO shows a good demand for the same. In most cases, the IPOs are oversubscribed. An investor can check the IPO subscription status quickly in the Choice FinX app by Choice.

IPO Allotment Meaning

IPO allotment means the allotment of shares to the investors. The IPO allotment status is a way by which the investors get to know how many shares are allotted to them.

Now the question is, how does IPO allotment work? There can be various cases in which the IPO allotment can differ. If an IPO has received fewer bids then the shares are given to every individual.

But in the case of an oversubscribed IPO, the IPO shares are allotted based on a lucky draw.

Wondering how to check IPO allotment status, you can easily get the required information on NSE or BSE information.

IPO Listing Meaning

When the IPO is listed in the stock exchanges or the secondary market per se, it is called the IPO listing. There are a lot of investors who often look for listing gains. This is also one of the reasons that IPOs are considered a good investment option for beginners.

To learn how to sell IPO shares in the secondary market to make money with listing gains and reap the benefit of IPO.

These are some of the common terms that are important to keep in mind when you are talking about an IPO.

How IPO Works?

Although we discussed the meaning of different terms used in IPO, what is the whole process of IPO or how IPO works in India?

Well! it works simply as the application process where the investors apply for the IPO they found interesting and beneficial.

But before it is made available for application, the company has to file the DRHP with SEBI where it needs to mention the objectives and goals of the IPO.

On approval from the SEBI, the company announces the IPO and brings the opportunity for the new and existing investors to start or plan to invest in.

So without any further delay let’s quickly take a glance at how you can apply for an IPO.

How to Apply for An IPO Online

So, now you can apply for an IPO offline as well by visiting the nearest bank or stockbroking branch and filling out the ASBA e-form, but the online process is easier.

One thing that you should keep in mind is that you have to open a Demat and trading account before applying for an IPO. You can do that in simple steps and with only a handful of documents.

You can apply for an IPO through ASBA from the Choice FinX app easily. ASBA or Application Supported by Blocked Amount is a procedure in which the desired amount is just blocked in your account when you apply for an IPO. The amount is only deducted when an IPO is allotted to you.

Now quickly have a look at ASBA Process required to fill IPO application.

- Log in to the Choice FinX app.

- Now on the right-hand side, you will find the IPO application option.

- Click on the IPO that you want to apply for.

- Enter the quantity and the price.

- Now enter your UPI ID.

- You will further receive a mandate to block a certain amount in your account. On approval, your desired amount will be blocked in your account.

Once the application is submitted, if get an allotment then you can sell IPO on a listing day to reap the benefit of listing gains.

Conclusion

If we talk about IPO meaning, then it is a procedure for any private company of going public and getting listed on the stock exchanges for investors. There are various benefits for the company like generating funds and better visibility.

But if we talk about wether Is IPO safe or not for the investors, then the answer is yes. IPO is beneficial for the investors as well as they can take the advantage of listing gains and become a shareholder of the company before the secondary market.

If you are looking for investment opportunities in an IPO, then open a Demat account today.

Recommended for you

How to Bid in An IPO?

FII DII Data - Live Data

Why ESG Matters for India’s Growth Story