How to Open Share Market Account?

- Published Date: December 29, 2021

- Updated Date: February 04, 2025

- By Team Choice

The share market is the space for all kinds of investors who want to build up their portfolio either by investing in ready-made funds or equity shares of the company, but to get started one needs to understand the process of how to open a share market account.

To invest in the share market one needs to have to open a trading and demat account. Most of the stockbrokers like Choice offer you the 2 in 1 account facility thus allowing you to reap the benefit of both.

But before beginning let’s get into the details of whether you are eligible for opening share market demat account in India or not.

- Who Can Open Share Market Account

- Share Market Account Opening Process

- Share Market Account Open Online

- Share Market Account Opening Documents

Open a FREE Demat Account in 5 Mins.

- Free AMC for First Year

- Low DP Charges (₹ 10)

- No Auto Square Off Charges

- Free Research Advisory

Who Can Open Share Market Account

In India, you get the voting right at the age of 18 but when it comes to investing in the share market you can begin your investment journey at the earliest.

So, irrespective of your age, the share market allows you to invest in shares by providing you the provision to open a Demat account.

However, those with the age less than 18 are eligible to operate a minor demat account. With demat account for minors, you can invest in the equity segment only.

On the other hand, one above 18 years of age can open a Regular demat account with the stockbroker offering advanced products and services at the minimum charges.

Just make sure that you have all the documents required for a demat account opening in the share market and open an account online by following a few registration steps.

Share Market Account Opening Process

Account opening in the share market is as simple as filling in your KYC details in the GPay or any other UPI platform.

Keeping a few important documents handy further makes it simpler for you to enter the stock market space.

Also, technology these days has made the process quick and simple. A keen investor having a smartphone, or laptop with a good internet connection can activate the demat and open trading account services online in a few minutes.

So, let’s see how this account opening process works.

Share Market Account Open Online

Gone are the days when you have to stand in a long queue to open an account with the stockbroker. Now every other stockbroker offers you the online way to register and open a share market account online.

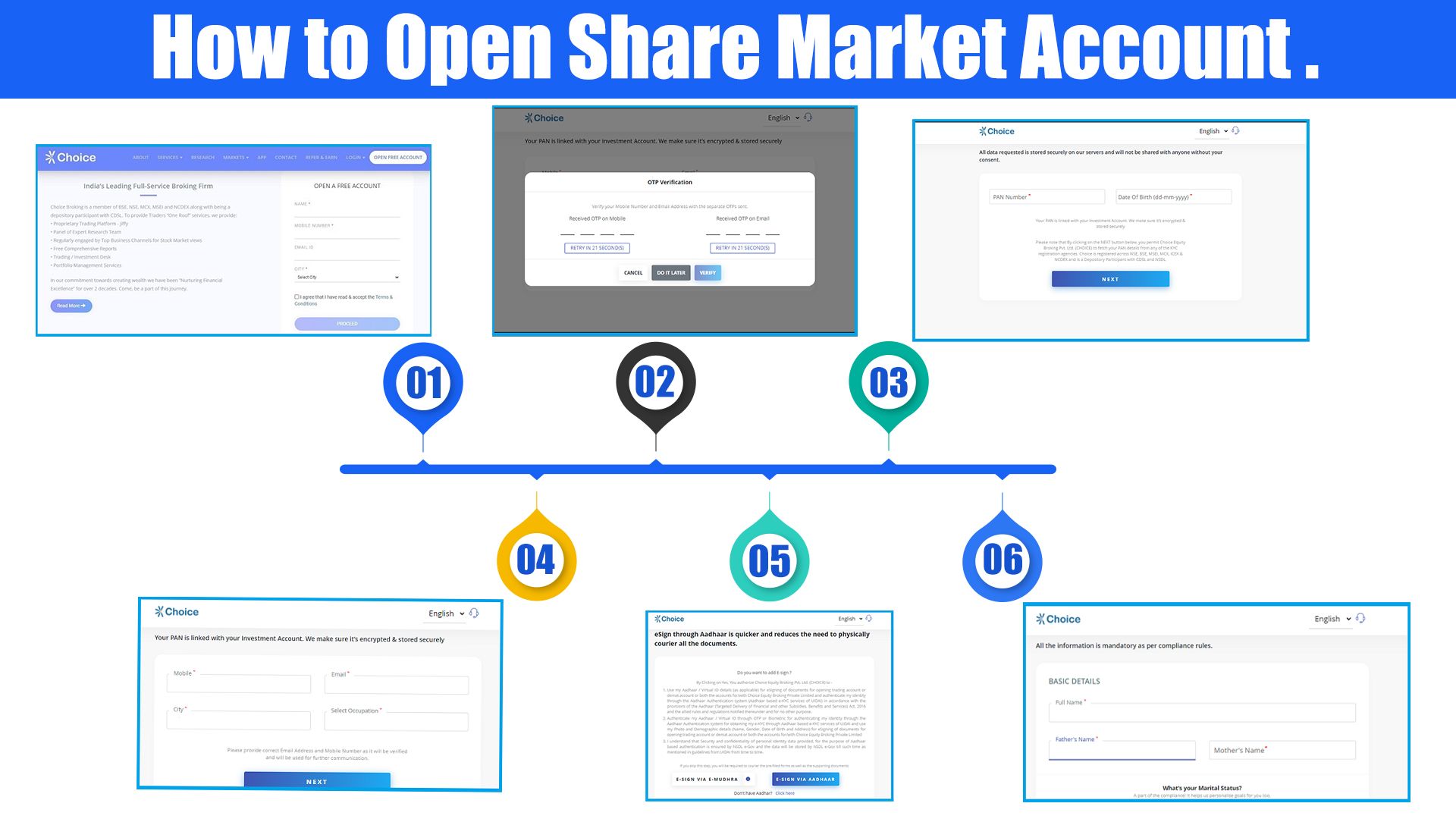

Here are the steps how to open trading account:

- Visit the stockbroker website and click on “Open a Demat Account.”

- Enter the mobile number and verify the same by submitting the OTP.

- Now submit the PAN Card and Aadhar card number.

- To validate the details, upload the documents to complete the KYC process.

- Fill in some basic details like a source of income, occupation, bank details, etc.

- Select the segment in which you want to trade and now select the brokerage plan.

- Proceed further for Aadhar verification where you need to submit the Aadhar number and the OTP received on the registered mobile number.

- Complete the process of in-person verification.

On successful validation, the trading account opens in a few minutes.

Now there are a few charges imposed by the stockbroker for demat account opening. Other than this there are account maintenance charges which are either charged monthly, quarterly, or annually.

Considering the Choice, the broker does not impose any account opening fees and further, the account maintenance charges are Rs. 250 per annum is charged annually.

Share Market Account Opening Documents

The account opening process is incomplete without the documentation but when it comes to submitting the documents, most of the investors remain confused.

It is obvious that there are multiple documents thus it is difficult for one to know which document is actually required for opening a share market account.

Let’s make this simpler for you by providing you with the list below:

| Share Market Account Opening Documents | ||

| Identity Proof | Identity Proof | Identity Proof |

| Voter ID Card | Aadhar Card | Passbook |

| PAN Card | Ration Card | Canceled Cheque |

| Driving License | Utility Bill | |

| Aadhar Card | ||

You can submit any one document as proof under each category. Apart from this one has to scan passport-size photographs and signatures to complete the process.

Conclusion

Following the above steps and choosing the right stockbroker you can begin your investment journey in the share market right away.

Just check for the documents and make sure you have a stable internet connection to avoid any hassle and hindrance in account opening.

FAQ

What are some key share market tips for beginners?

Share market tips are research, diversify, stay patient, and avoid impulsive decisions. A long-term perspective is often rewarding.

Recommended for you

Garment Mantra Lifestyle Ltd Rights Issue 2025

FII DII Data

Crude Oil Price Forecast for Next Week