Choice International Endeavours to Lead You Towards Financial Prosperity

- Published Date: January 18, 2023

- Updated Date: November 28, 2025

- By Arun Poddar

I recently came across this famous quote by Robert J. Shiller- “Finance is not merely about making money. It’s about achieving our deep goals and protecting the fruits of our labour. It’s about stewardship and, therefore, about achieving a good society.” With this thought in mind, we at Choice International aspire to serve communities by endowing them with best-in-class and highly-customized financial services that offer optimal returns with minimum risk.

Established since 1992, Choice International is organized into several subsidiary firms, sister concerns, and brands, all of which work in unison to become ‘The Best’ in their respective fields of expertise. Collectively, we as a conglomerate currently offer a wide range of financial services that include Choice FinX: Our wealth management platform for Stock Broking, Insurance and Mutual Funds, Choice Money: Our lending platform for MSME customers and Advisory: Management Consultancy, Investment Banking, Government Consulting, etc.

Performance for the Quarter

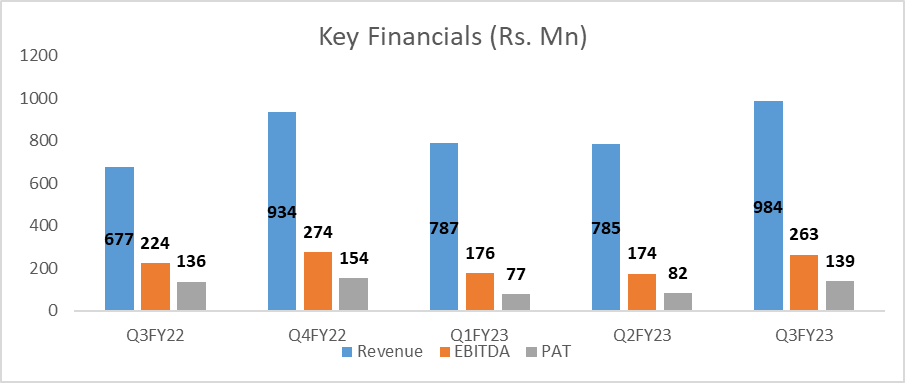

Financial Performance:

Q3FY23 has been another quarter of phenomenal performance. As we enter the final quarter of the financial year, we are pleased to report that Choice continues to perform well and is set to achieve its financial targets for the financial year 2022-2023. Our revenue for the year is on track to exceed expectations, Choice has delivered revenue of Rs. 984 Mn, representing a growth of 45% YoY. Consolidated EBITDA and PAT for Q3 FY23 was Rs. 263 Mn and Rs. 139 Mn respectively.

Business Segment Performance

Choice International strives endlessly to serve your financial interests with perseverance, enthusiasm, and hard work. During the quarter, all of the company’s business verticals continued to grow and exceed our expectations. As an organization, our core strength, the Broking & Distribution business has exceeded our expectations and has clocked in a total revenue of Rs. 645 Mn with an active client base of 263k+ accounts. Despite a flattish trend in the growth of demat accounts in the industry, in the third quarter, 33K new demat accounts were opened and took the total demat accounts to 640K+.

Our Mutual Fund business has an AUM of Rs. 3,630 Mn with an SIP book value of Rs. 40 Mn. The mutual fund industry as a whole is growing exponentially backed by huge demand from the youth of our nation. This plays well for us as most of our clientele is in the age group of 18-35 years.

Similarly, Insurance has clocked in a total premium of Rs. 96 Mn with more than 3,700 policies sold for this quarter. We have seen that small ticket insurance has a huge potential in India and therefore are working on a plan which is the right mix of coverage and is affordable too.

Fintech is the new buzz and we are focusing on adopting the latest tech trends in the industry to serve you better. A majority of our transactions are executed online via the proprietary Super app- Choice FinX, which provides convenience to invest in an array of financial instruments without the hassle of managing multiple apps for different products. Choice FinX is designed in a way that it hosts a plethora of cutting-edge technological innovations, simplifying the user experience.

Choice’s in-house team of industry experts lends the organization the technological prowess to develop easy-to-use APIs for you. As of today, we are successfully serving 14Mn+ API requests per day.

Our newest addition to the business, the NBFC business has performed significantly well this quarter, having a loan book of Rs. 3,235 Mn with the NNPA of 0.01%. Choice Money, our proprietary platform aims to assist you in digital lending and payment processes, which helps in fastest ever in-principal loan approval. Furthermore, we aim is to serve the MSME sector and serve 10X more MSME customers in the underserved geographies in the next three years.

Choice’s strong and experienced advisory team lends the organization an edge in the management consultancy and government advisory business. This has enabled us to efficiently deliver government projects across 10+states with a current order book of Rs. 3.44 Bn.

What Differentiates us?

We are listed as one of India's top 15 brokerage houses, having a pan-India presence across 18 states, with 79 branches and 30k+ CBAs. We take great pride in having a unique asset-light business model – ‘Choice Connect’. As a firm, we believe in the importance of personal touch in financial services, thus we operate on a "PHYGITAL" model to serve customers via our Choice Business associates (CBA’s), a feature that effectively caters to Tier III & IV and rural areas. As of today, we have more than 30k+ CBAs catering to Tier III & rural areas which contribute 68% to our active client base.

Choice’s CSR initiatives are in line with the company’s motto: आप कीजिए कामयाबी की तैयारी, बाकी हमारी ज़िम्मेदारी. We actively promote the upliftment of disadvantaged rural communities in rural geographies, with a particular emphasis on marginalized populations. Recently, we have announced the introduction of the 'Saarthi' program in January 2023. As part of the program, we compiled 3,000+ high-quality films on our instructional YouTube channel, which has been curated by a team of educational specialists. This effort benefits students from all over the nation by providing free high-quality education in vernacular languages to pupils of all ages in preparation for key competitive exams.

Choice’s strength lies in its people and today we are a family of 2,000+ dedicated employees who tirelessly work to elevate Choice’s standards. This quarter, we have granted 9,62,500 employee stock options to eligible Employees under the "Choice Employee Stock Option Plan 2022" (ESOP 2022).

Our Future Plans:

While our primary goal is to always make our your life simpler and easier, moving forward, our key priority will be to improve service quality and serve markets across India, especially in Tier-3, Tier-4, and Tier-5 cities, which we think will drive the country's next cycle of economic development. Furthermore, reaching out and increasing our footprint beyond Tier 3 cities may result in financial inclusion for those who have yet to have access to the power of capital markets in the nation.

Additionally, we aspire to extend our NBFC geographical operations from Tier 3 to Tier 6 cities, while also significantly broadening the scope of our retail lending services by offering MSME loans, commercial vehicle loans, and supply chain financing.

Moving forward, our commitment towards excellence and growth remains unchanged. We will never cease to prioritize your satisfaction and innovation, while also seeking out new opportunities for expansion and diversification in India. Equipped with favourable demographics, a robust economy, and supportive government policies, the potential for success and value creation for our shareholders will be tremendous.

Recommended for you

How To Sell Mutual Funds In India: Everything You Need To Know

What is Dabba Trading: Meaning, Risks, and Reality Explained

FII DII Data - Live Data